LEASING: ANSWERING YOUR QUESTIONS

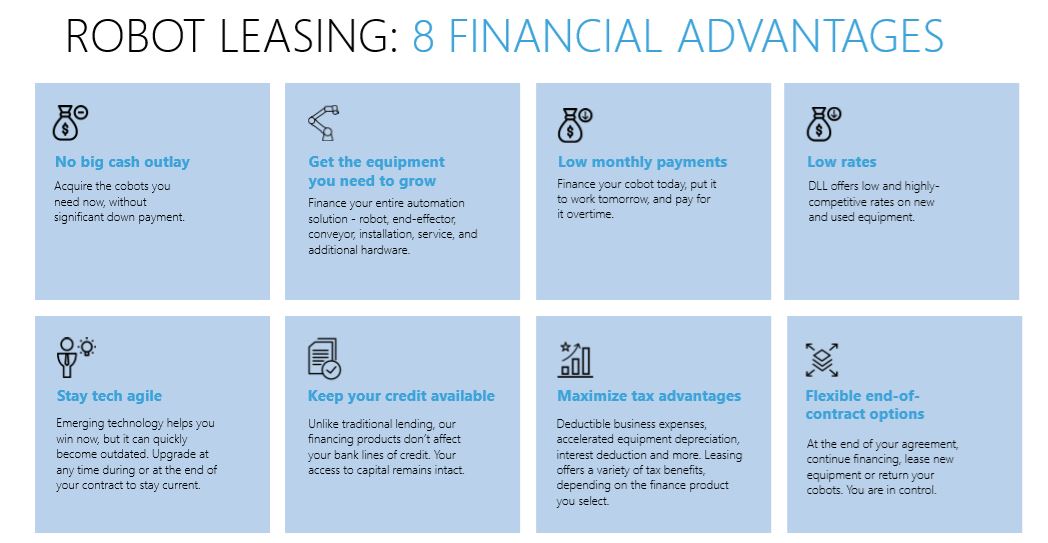

Customers Leasing gives you both the equipment you need today and the ability to upgrade tomorrow. These frequently asked questions (FAQs) give you the ins & outs of leasing, so you can take full advantage of the many benefits it can offer your business.

Q: What is leasing? An equipment lease is a contract for the use of specific piece(s) of equipment for a set period (generally 24–72 months) against fixed monthly payments that are agreed upon in advance.

Q: Why should I lease equipment rather than purchase it outright? You don’t pay your employees a year in advance, but as they contribute. Why should it be any different with a contributing asset like business equipment or technology? Leasing (or ‘financing’) lets you pay as you use the equipment, not before. So, the equipment starts generating income even before you’ve made your first payment.

Q: Does equipment leasing provide tax benefits to my business? Leasing is advantageous to most businesses in that monthly lease payments can often be deducted as an operating expense, reducing your taxable income. * *Check with your financial advisor

Q: How do I know if I’ll qualify for a lease? Preferably, it is an established business with a good credit record that have been in existence for a minimum of 2 years. But there are all sorts of circumstances in which a business qualifies for a lease.

Q: How long does the credit process take? Provided all the required application and financial statements, credit decisions are generally rendered within a few days.

Q: What happens at the end of the lease? Lease agreements include clear end-of-lease options that vary depending on the type of financing requested. Generally, customers can extend lease, return equipment, keep it, or upgrade for a new model. Early return options are also possible. Please refer to your end-of-lease options to see the options that apply to you.

Q: How do I know if a lease is the right choice for my business? If any of the following apply to your situation, consider a lease option that fits your company’s budgetary requirements: –– The equipment you need to be competitive will be obsolete in a few years –– You’d like to find a more efficient way to manage cashflow –– You’re looking for off balance sheet financing and possible tax advantages –– You want 100% cost coverage (including ‘soft’ costs)

Q: What is the down payment requirement? Payment plans and down payment requirements can be worked out directly with the leasing company.

Q: What costs can be included under a leasing agreement? Everything you purchase through your UR partner (robots, end-effectors, installation, service, etc.) can be added to the agreement.

Q: How long does the credit process take? Provided all the required application and financial statements are provided, credit decisions are generally rendered within a few days. Q: What happens at the end of the lease? Lease agreements include clear end-of-lease options that vary depending on the type of financing requested by the customer. Generally, customers can extend the lease, return equipment, keep it, or upgrade for a new model. Early return options are also possible. Q: Are rates fixed or variable? UR customers will work directly with the leasing company to establish terms.

Q: What happens if I want to change or end my lease early? Work with the leasing company to set up your desired end-of-lease terms.

Q: Am I responsible if the equipment if damaged or destroyed? Refer to the terms of your lease.

Q: Who insures the equipment? Insurance of the assets are the responsibility of the lease.

Q: What are the procedures if I return the equipment? Refer to the terms of your lease.

Q: Can my lease also include a service contract? Yes. Most every expense connected with the purchase of your robot can be included in the lease.

Q: If I want to buy my lease out early, is there a penalty? See the terms of your lease.

Q: Are there extra costs or hidden fees at the end of the lease? All costs will be outlined in the terms of your lease.

Q: Can a start-up business obtain a lease? The leasing company will consider all companies in good standing.

Q: Are there any upfront costs or fees? There are no fees or upfront costs required from UR. All leasing costs and fees will be clearly indicated by the leasing company.

Q: How are payments made? Payments are paid directly to the leasing company.

Q: Who’s responsible for taxes? The customer is responsible for all taxes.